Real Estate Gets a Boost in Budget 2019

Category :

Blog posted by : Admin / 02 Feb, 2019

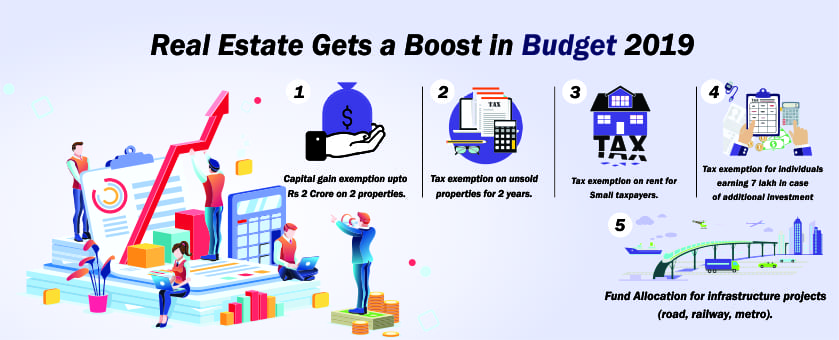

On Friday, Feb 1, 2019, Union Finance Minister Piyush Goyal presented much-awaited interim budget 2019 in Lok Sabha. All the Indian people and industries were waiting to reap the gains from the 2019 budget. The union budget 2019-20 is far more effective than all the previous budgets according to some economists. This year's budget focuses more on providing relief to farmers and rather than putting them in distress. The budget proposal is likely to give an additional amount to farmers having land up to 2 hectares. On the other hand, Finance Minister Piyush Goyal has opened the doorway of tax exemption for middle-class people, real estate and infrastructure industries. The significant relaxation in taxable policies on real estate will encourage investment from even the middle-class people.

Here are some gains for middle-class people and real estate developers from interim budget 2019.

1. Capital gain exemption up to Rs 2 Crore on 2 properties:

The advantages of rollover of capital gain are to be increased from investment in one residential property to that in two residential properties for a taxpayer having accumulated capital gain upto Rs 2 crores. If a person buys and sells 3 properties, then he/she is liable to pay capital gains tax on the profits gained from selling the 3rd property. In this scenario, an owner can enjoy the full profit from selling 2 properties. But this benefit can be availed only once in a lifetime. This policy has definitely filled every property owner to direct more investment towards the real estate industry. Hence real estate developers can enjoy the indirect benefit of capital gain.

2. Tax exemption on unsold properties for 2 years:

No tax to be payable by any real estate developers for holding the unsold property up to 2 years from the end of the year in which the project is completed. The announcement of this policy has thrilled every real estate developer. As real estate developers get extra one year to sell the property with the right marketing strategies. 2-year tax relaxation can prove to be enough for a customer to book a flat.

3. Tax exemption on rent for small taxpayers:

TDS threshold for deduction of tax on rent has been proposed to be increased from Rs 1,80,000 to Rs 2,40,000. With this policy, small taxpayers can enjoy the rent amount upto 2,40,000 without having to pay any tax on rent. This policy can attract small investors to buy properties where the TDS on rent lies lower than Rs 2,40,000 annually. Therefore this policy gives relief to small taxpayers. Now one single person can possess two properties without having to pay notional tax on 2nd property which is not let out. In this case, the owner, having 2 properties, does not bear the burden of putting the 2nd property on rent just to avoid tax.

4. Fund Allocation for infrastructure projects (road, railway, metro):

Finance Minister Piyush Goyal has increased the overall expenditure programme for infrastructure projects including railways, roadways, and metro. Interim budget has even promoted a plan for rural areas named as "Pradhan Mantri Gram Sadak Yojana" which is being allocated Rs 19,000 crores in 2019-20 as against Rs 15,500 crores in 2018-19.

5 Tax exemption for individuals earning 7 lakh in case of additional investment:

Before the 2019 budget, the income above 2,50,000 used to be taxable which was the only factor that put a salaried person in a taxable section. But with the new tax policy of the government, a salaried person, with total income up to Rs 7 lakh, will not have

to pay taxes if one uses an proper investment strategy with a limit of Rs 1.5 lakh along with Rs 50,000 under standard deduction. It means if a taxpayer, with the salary of Rs 7 lakh, makes an investment in the provident fund and prescribed equities, then he/she will not pay tax on the income. On the other hand, individual salaried person, with the salary of Rs 5 lakh doesn’t need to pay tax. Such policies will induce people from middle-class section to hunt for investment opportunities either in the stock market or real estate.

With the proposal to tax capital gains last year and reducing capital gains from real estate this year, there are indications to pull Indian households back to property-buying.